プロスペクト理論

概要

ソース: ジョナサン ・ Flombaum 講座-ジョンズ ・ ホプキンス大学

ドルの価値は何ですか。通貨は貿易を容易にするために値を格納します。すべての経済取引では、通貨の単位の値です。しかし、ドルの主観的な価値とは何ですか。長い間、経済学者が、具体的には、ドルが市場によって決定される値を持つことと、ドルの主観的な値は常に、多かれ少なかれこの質問への答えを想定しています。

実験心理学者ダニエル ・ カーネマンとエイモス ・ トベルスキーは 1970 年代初頭に始まって、この仮定は、特に通貨の主観的な価値は、いくつかの要因に依存することを示す、損益が議論されているかどうか、およびトランザクションの全体的なサイズをひっくり返されました。直感をポンプは、ほとんどの人に、事実を考慮、ガスのガロンに $2 を保存するために余分な半マイルを駆動する合理的なようです。しかし、非常に少数の人々 が新しい車の費用に $2 を保存する同じを行うでしょう。$2 は時々 が常に余分な半分マイル ドライブの価値があります。値は、コンテキストによって異なります。

どのように人々 は心理的に通貨値を記述する・ カーネマン ・ トベルスキーによって考案された理論 (、商品やサービス、一般的に) プロスペクト理論と呼びます。2002 年、関連の研究手法と実験心理学の理論を使用して (・ トベルスキー逝去 1996 年) 経済の意思決定を理解すると共に、・ カーネマンがプロスペクト理論のノーベル経済学賞受賞。

プロスペクト理論の主な影響の多くは、調査実験により得られました。調査から成っていたギャンブル; 間の選択肢たとえば、被験者は、5 ドルまたは 10 ドル勝利の 50% の確率で何も受信しないリスクを受信したいかどうか尋ねられるあります。

このビデオは、プロスペクト理論の研究で使用される調査問題の種類を設計するための手順を説明します。

手順

1. 刺激デザイン

- オプションは、成果と確率に知られている、エコノミストは、選択肢の期待値と呼んで、それぞれ確率で加重の結果の平均値として各選択肢の値を説明します。

- たとえば、$5 の保証された勝利は $ 5、期待値との $5: 0.5 x 0 + 0.5 x 10 = 5 の予想値も 10 ドル、時間 (および何も時間の他の 50%) の 50% を支払うギャンブル。

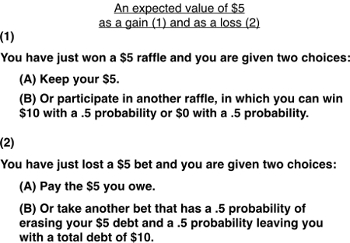

- 工夫は、プロスペクト理論を研究するための適切な調査を設計するために類似または同じ期待値(図 1)、にもかかわらず、別の決定につながる傾向がある賭博します。

図 1。2 つの賭博の利益 (1) または (2) の損失と等しい期待値 ($5) の選択肢から成る。両方の選択肢の期待値は、ギャンブル 1、$5 の利得です。両方の選択肢の期待値は、ギャンブル 2、5 ド

結果

申請書と概要

タグ

スキップ先...

このコレクションのビデオ:

Now Playing

プロスペクト理論

Cognitive Psychology

11.2K 閲覧数

聴テ

Cognitive Psychology

26.7K 閲覧数

減算の反応時間とドンダースの測定

Cognitive Psychology

44.4K 閲覧数

機能や接続詞の視覚探索

Cognitive Psychology

26.9K 閲覧数

認知心理学の視点

Cognitive Psychology

7.0K 閲覧数

両眼視野闘争

Cognitive Psychology

8.0K 閲覧数

複数物体追跡

Cognitive Psychology

7.8K 閲覧数

おおよその感覚テスト

Cognitive Psychology

7.6K 閲覧数

心的回転

Cognitive Psychology

13.2K 閲覧数

言語的作動記憶容量を測定

Cognitive Psychology

12.5K 閲覧数

視覚ワーキング メモリ遅延推定精度

Cognitive Psychology

5.2K 閲覧数

ことばによるプライミング

Cognitive Psychology

15.0K 閲覧数

付随のエンコーディング

Cognitive Psychology

8.6K 閲覧数

統計学習

Cognitive Psychology

7.1K 閲覧数

鏡映描写の運動学習

Cognitive Psychology

55.6K 閲覧数

Copyright © 2023 MyJoVE Corporation. All rights reserved